In Short

-

Notify the employee promptly upon discovering the overpayment.LegalVision UK

-

Agree on a repayment plan, ideally in writing, considering the employee’s financial situation.

-

If the employee disputes or refuses repayment, seek legal advice before taking further action.

Tips for Businesses

To prevent overpayment errors, ensure your payroll system is regularly updated and double-check calculations before processing payments. Clearly outline in employment contracts the procedures for handling overpayments, including repayment terms. Maintain open communication with employees about payroll matters to foster trust and transparency.

In the complex world of payroll management, mistakes can happen. One of the more challenging errors to address is the accidental overpayment of wages. As an employer, you are juggling multiple responsibilities. It is no surprise that occasional slip-ups occur, and you may overpay your employees. Reclaiming overpaid wages, if not handled properly, can quickly escalate into a dispute with your employees. This can potentially damage workplace relationships and even lead to legal complications. This article will equip you with the knowledge and tools you need to handle this delicate issue effectively and legally.

When Can You Deduct Money From Your Employees’ Pay?

If you need to deduct money from your employee’s wages, there are only certain circumstances when this is lawful. One of these is where you have overpaid them by mistake, such as through a payroll error. Due to a payroll error, employees may have received more pay than they were entitled to.

You should note that where you made an overpayment more than six years ago, you are not legally entitled to reclaim it.

Other situations where you can deduct money from your employees include where:

- their employment contract states that you can do this;

- you and your employee have agreed in writing that you can do this;

- you are under a legal obligation to make deductions, such as for National Insurance or Income Tax; and

- your employees were not at work due to industrial action or strike.

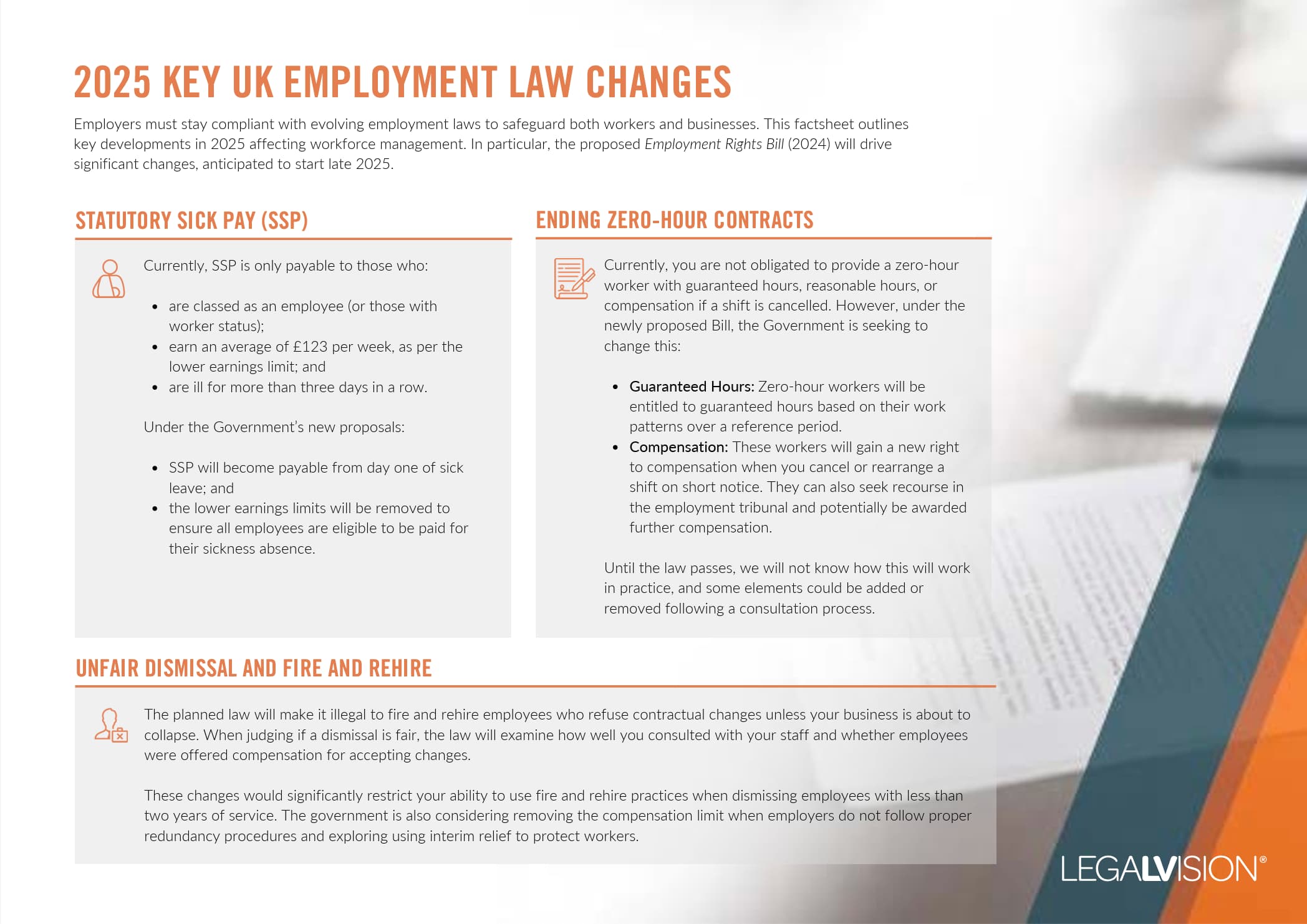

This factsheet outlines key developments in 2025 affecting workforce management.

What to Do if You Overpay Employees

Whilst an overpayment of your employee’s wages means that you have a right to deduct money from their pay to reclaim it, there are ways you should go about doing so as good practice. Firstly, you should let them know that you have accidentally overpaid them and should do this as soon as you identify that this has occurred.

Secondly, you should inform them of the amount they have been overpaid and your intention to reclaim it. For example, you can reclaim it as a single lump sum or claim it back in instalments, but you must provide your employee with notice before recovering an overpayment. Repayment will generally be through a deduction in your employee’s next pay, but they wish to repay the overpayment differently, such as through a bank transfer.

Repayments

You should be flexible when asking your employee to repay the overpayment. This is especially the case where you made the overpayment some time ago. Therefore, offering your employee a repayment plan that suits their financial situation is good practice. In addition, it is good practice to put any repayment agreement in writing.

Where you do not have your employee’s consent, or you did not provide notice, your employee may claim breach of contract or constructive dismissal. Constructive dismissal is when an employee leaves your workplace because you have violated the terms of their employment contract. It is only applicable to employees with over two years of service.

Continue reading this article below the formCall 0808 196 8584 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

What Happens if the Employee Defends the Overpayment?

Your employee may be in a position to defend against the overpayment and refuse to repay you. For example, your employee might refuse if you:

- made the overpayment a long time ago; or

- cannot agree on a repayment plan.

Furthermore, your employee could argue that you led them to believe they were entitled to the overpayment. Consequently, the employee could state that they relied on this representation. On these occasions, you may consider writing off the overpayment.

Change of Position

Your employee has a defence to a claim of overpayment if they can prove that their position has changed so that it would be unjust to require them to make repayments. For example, if you overpay your employees and they spend the amount on essential needs, assuming that it was part of their income, they may not be obligated to repay you.

What Happens if the Employee No Longer Works for You?

You can recall accidental overpayment of your employees’ wages by deducting them from their pay. However, this will not be possible if the employee no longer works for you. Where this occurs, you should make an informal request for repayment. You should initially contact them and explain that you made an overpayment of their wages, and confirm the amount.

Your previous employee may offer to repay the amount. However, you may find that a previous employee refuses to repay it. Where this occurs, you may be able to claim the overpayment through the civil courts, if informal steps prove to be unsuccessful. However, the cost of court proceedings could outweigh the amount you overpaid your employee. In this instance, it would be wise to reconsider whether or not to pursue litigation, as you could incur additional costs.

Key Takeaways

If you overpay employees, you can generally reclaim these overpayments. However, if the overpayment occurred six years ago, you do not have a legal right to reclaim it. Also, your employee may defend the claim because you led them to believe they were entitled to the overpayment. Therefore, when you request an overpayment of wages from your employee, you should consider the financial impact on the employee.

If you need help regarding employee overpayments, our experienced employment lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents for a low monthly fee. So call us today on 0808 196 8584 or visit our membership page.

Frequently Asked Questions

As an employer, you have the right to recover any amount you accidentally overpay to your employees. However, you do not have a legal right to where the mistake occurred more than six years ago.

An employee can defend an overpayment of their wages if you led them to believe the money was theirs and consequently relied on your representation.

We appreciate your feedback – your submission has been successfully received.