Your company’s business activities can vary when you run a small business. There may be times when you are busy and doing well and times when things are quiet. You may also change your business activities, such as by expanding or reducing them. As an employer, there may, therefore, be a time when you need to make redundancies. There are many rules on making redundancies, which you must be aware of and abide by, or you could face a tribunal claim. This article will explain the legal requirements for small businesses in terms of enhanced redundancy pay.

Why Might I Make Redundancies?

When your small business makes redundancies, you, as an employer, dismiss staff to reduce your overall workforce. You may make redundancies in your business when you undergo changes such as restructuring or reducing your workload, which may mean stopping a production line or no longer offering a specific service. You could also have to make redundancies in your company because you have financial problems and can no longer afford such a large number of staff.

However, there are rules regarding the redundancy process, which you must follow to ensure a fair process.

What is Statutory Redundancy Pay?

When you make your staff redundant, by law, you have to offer them redundancy pay where they meet the legal criteria. The minimum you must pay them is the statutory redundancy pay amount. Usually, your employees who have been working for you for at least two years will have an entitlement to this, and there are rules you have to follow in terms of how much you pay them.

Continue reading this article below the formCall 0808 196 8584 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

What is Enhanced Redundancy Pay?

Rather than offering your employees statutory redundancy pay, you can offer them a higher rate, known as enhanced redundancy pay. Whilst you do not legally have to offer this, you may decide to in order to:

- help your staff as they are losing their job;

- encourage voluntary redundancy; and

- reward loyal staff.

What are the Legal Requirements?

Your employment contracts will detail whether you pay staff this, and if so, it is a contractual obligation you must honour. This is an express incorporation.

Calculating Enhanced Redundancy Pay

One of the rules about enhanced redundancy pay concerns how you decide to calculate it. You can choose how to do this, but you must follow a fair process when you do so. For example, you may decide:

- to increase the weekly amount an employee has to earn from the statutory amount to get redundancy pay;

- not to have a minimum weekly amount an employee needs to earn before they receive redundancy pay;

- to base it on years of service or age; or

- to multiply the total amount of redundancy pay.

However, you must be cautious not to discriminate against your employees. Specifically, as age is a protected characteristic, calculating enhanced redundancy pay using an employee’s age could result in discrimination against younger employees.

One way to avoid discrimination is by following the rules in the Equality Act 2010, which excludes statutory and enhanced redundancy pay from the age discrimination rules. However, these rules can be confusing, and you should seek clarification from an employment lawyer.

Tax Rules

If you offer your employees enhanced redundancy pay, you should be aware that it, like statutory redundancy pay, is tax-free, up to £30,000. So, you will add this to the statutory amount, and they will only pay tax on any amount over £30,000. This amount is also liable for national insurance contributions. However, tax rules can vary slightly depending on your employment contract, so you should check with your legal adviser.

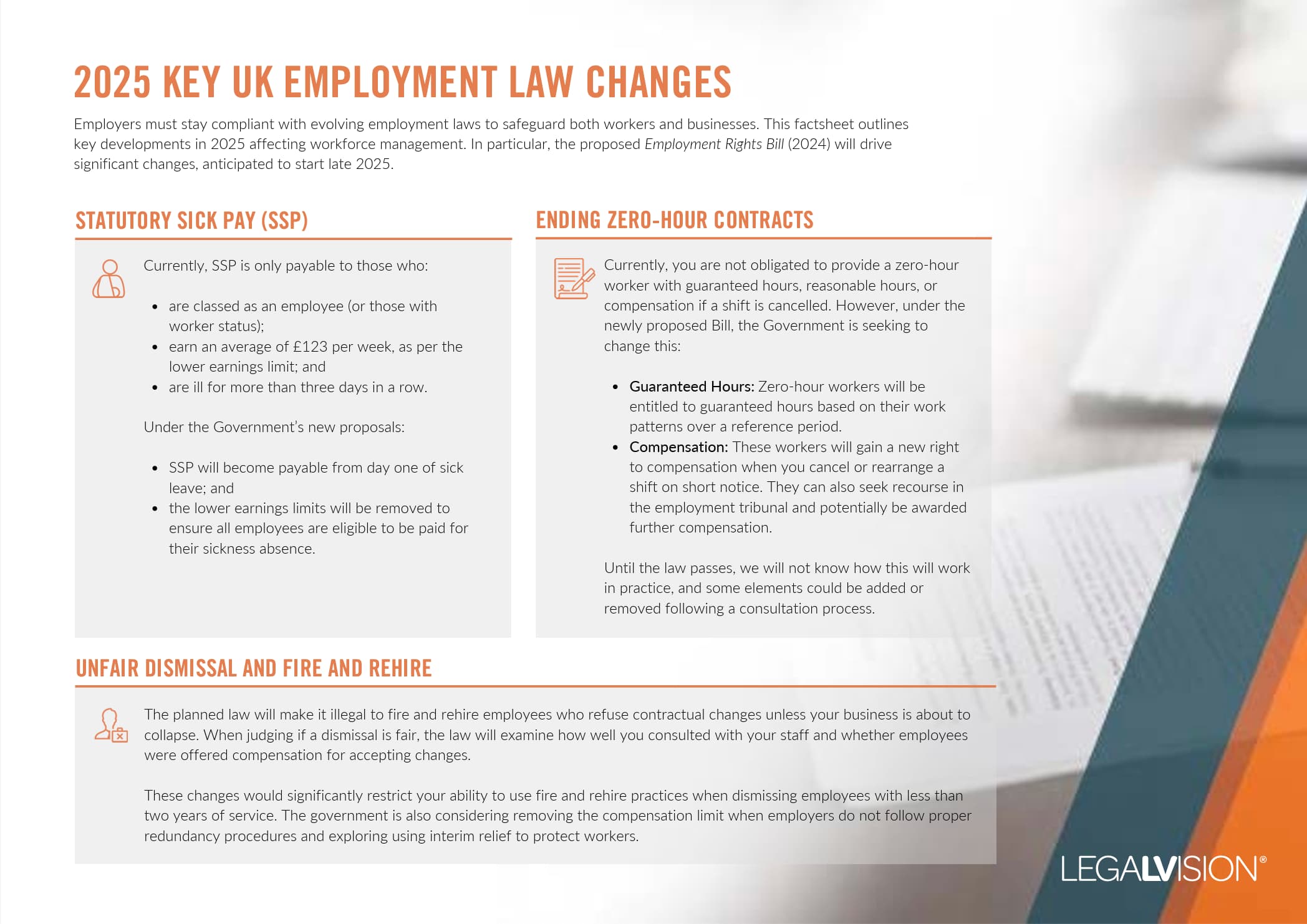

This factsheet outlines key developments in 2025 affecting workforce management.

Key Takeaways

As an employer, you may reduce your workforce through dismissal, such as by restructuring your business. If so, where they qualify for statutory redundancy pay, you must pay them this. However, you can offer more than this where you provide enhanced redundancy pay, and you must follow specific legal requirements. These include those about calculating it where you must ensure, for example, that you do not illegally discriminate. However, despite differences in the amount due to being part-time, this is not considered sex discrimination. There are also tax rules on enhanced redundancy pay where tax is not payable unless the amount due is over £30,0000.

If you need help understanding redundancy in the UK, LegalVision’s experienced employment lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. So call us today on 0808 196 8584 or visit our membership page.

Frequently Asked Questions

This is where an employer offers more than the statutory redundancy pay when making staff redundant.

Both statutory and enhanced redundancy pay are tax-free, provided they do not exceed £30,000.

We appreciate your feedback – your submission has been successfully received.