In Short

- From April 2024, the National Living Wage applies to everyone aged 21 and over, with specific rates for younger workers and apprentices.

- Avoid compliance issues with overtime pay, deductions, and holiday overpayments that might drop wages below minimum rates.

- Keep up with annual changes, accurately log working hours, and ensure contractual terms align with minimum wage laws.

Tips for Businesses

Regularly review pay rates and working hours to ensure compliance with minimum wage laws. Monitor annual rate changes each April and keep contracts clear about deductions, overtime, and additional hours. Maintaining accurate time records will help you avoid costly errors and protect your business from legal claims.

In today’s dynamic business environment, employers face many challenges. One is adhering to the ever-evolving minimum wage requirements. As the cost of living continues to rise and societal expectations shift, the pressure on businesses to ensure fair compensation for their workforce has never been greater. This article delves into the intricacies of minimum wage compliance. It also aims to offer insights and strategies for employers to meet their legal obligations. This could help foster a culture of fairness and equity.

From understanding the nuances of the National Minimum Wage and National Living Wage to implementing robust payroll systems, we explore how businesses can navigate this complex terrain while maintaining operational efficiency and employee satisfaction. This article explores key considerations and best practices that will help employers stay ahead of the curve.

What are the Minimum Wage Requirements?

Earning a fair wage is a fundamental right for every worker. In the UK, the Government has set minimum wage standards to ensure employees receive appropriate compensation for their work hours. These standards are the National Living Wage (for those over 21) and the National Minimum Wage (for those under 21). The national living and minimum wage requirements change every April.

As of 1st April 2024, the current rates are as follows:

| Band | Current rate |

| 21+ (National Living Wage) | £11.44 per hour |

| 18 – 20 | £8.60 per hour |

| Under 18/ Apprentice | £6.40 per hour |

This year, the national living and minimum wage requirements have changed beyond the usual yearly increases. Before April 2024, there used to be a 23+ age bracket for the highest minimum wage. This has now been reduced to all those over 21.

Employees are legally entitled to be paid at least the national minimum or living wage, depending on their age.

Some examples of workers who will also be entitled to the correct minimum wage are:

- part-time workers,

- casual labourers or agency workers,

- apprentices, trainees and workers on probation.

What are the Most Common Situations Where Employers Fall Below Minimum Wage Requirements?

Overtime

Employees who work overtime can commonly earn less than the minimum wage if their hourly or yearly salary is closer to the current minimum wage requirements. Therefore, ensuring that overtime does not reduce an employee’s salary below the minimum wage is essential.

Those on an hourly wage should continue to be paid their basic pay rate for any additional hours worked. This is unless you have provided a contractual right or it’s a common practice in your business to provide a premium rate for extra hours.

Deductions and Payments

Sometimes, employers overpay their employees. Or, at the end of their employment, an employee may take too much holiday or fail to return company equipment. A business may deduct money from an employee’s wage to cover this in these instances.

A way around this issue would be to pay any final outstanding wages owed to the employee and then send a separate letter pursuing the amounts owed unless the deduction would not lower the employee’s wage below the minimum wage. Finally, it is essential to note that you can only deduct from your employee’s salary if you have the contractual right to do so.

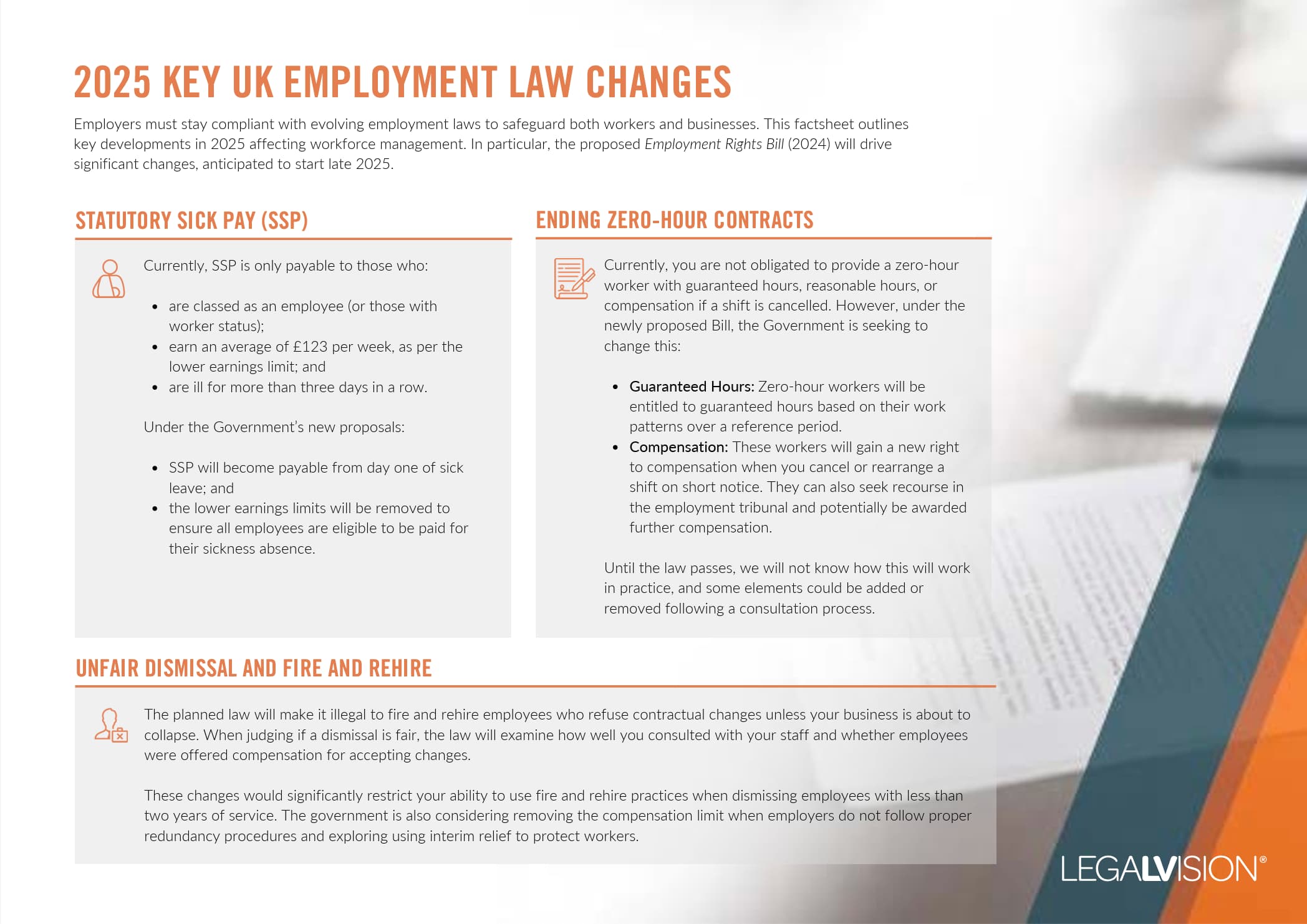

This factsheet outlines key developments in 2025 affecting workforce management.

Call 0808 196 8584 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

How Can You Ensure That You Are Remaining Compliant With Minimum Wage Requirements?

Keeping Up to Date

A common oversight, but arguably the most avoidable way to fall below the minimum wage requirements, is to ensure that you are up-to-date with changes in the minimum wage rates.

Each April, the wage rates change. As a Labour Government settles in, additional looming changes to the national minimum wage could be on the horizon. These changes could be configured to consider factors such as the cost of living. Next year’s minimum wage increase should be one for all employers to look out for.

Time Sheets and Logging Your Staff’s Hours Worked

You can ensure you do not fall below your wage obligations by accurately logging and reporting your staff’s hours. You can calculate whether the time they have worked requires additional compensation or can be encapsulated in the salary they are already receiving.

This is especially important in circumstances where employment contracts may stipulate an annual salary and include clauses that refer to the potential need to work additional hours to meet your duties/ business needs without additional compensation, as this extra time can be expected without further remuneration, insofar as it does not fall below the minimum wage requirements.

Key Takeaways

It is essential to keep up with the annual changes in the NMW. You must also accurately log your staff’s working hours. This means they can be remunerated for this work. This also enables you to ensure that any additional hours worked do not reduce the hourly rate below the statutory minimum wage if they are paid an annual salary.

If you require any further information regarding remaining compliant with wage requirements, our experienced employment lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 0808 196 8584 or visit our membership page.

It is against the law for employers to fail to meet minimal wage requirements and can lead to negative consequences for business owners.

If an employee believes you are not meeting NMW requirements, they can contact Acas or HMRC to raise a complaint.

We appreciate your feedback – your submission has been successfully received.