In Short

-

Performance-related pay (PRP) ties compensation to individual or team performance, motivating employees to align with company goals.

-

Implementing PRP can enhance employee engagement, retention and productivity.

-

It’s crucial to establish clear, measurable performance metrics and ensure transparency in the evaluation process.

Tips for Businesses

Develop a comprehensive PRP strategy that includes setting specific, achievable performance targets. Communicate the criteria and process clearly to all employees to ensure fairness and transparency. Regularly review and adjust the system to maintain its effectiveness and alignment with business objectives.

When you employ staff to work for your company, you want them to try their best and work to high performance to achieve the goals of your business. As a business owner, it is also essential to show your staff that you appreciate them and to encourage them in their individual performance. One way to enhance employee performance is to offer pay schemes such as a performance-related pay scheme with bonus payments for good performance. If you decide to implement this system, you must understand any legal implications. This article explains how to implement a performance-related pay scheme in terms of legal considerations.

What is Performance Related Pay?

Performance-related pay is when you offer your employees extra remuneration for performing well or for their efforts. For example, if you run a handmade clothing business, you may pay your staff an additional amount for making more clothing items or for meeting their monthly targets. Therefore, you evaluate your employee’s performance and increase their pay to reflect this. It is, therefore, additional pay to their regular salary.

Why Should I Implement Performance-Related Pay?

There are many reasons that employers like you may decide to implement performance-related pay. Performance-based pay can, for example, help communicate to your employee what their goals are. Additionally, it can:

- encourage staff commitment;

- help employees focus on your company’s overall objectives; and

- encourage your workers to perform their best efforts.

However, while implementing a performance-related pay system can have benefits, no law requires it.

Continue reading this article below the formCall 0808 196 8584 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

What Are the Legal Considerations?

There are some legal implications if you decide to implement performance-related pay. For example, you must not deduct from your employee’s wages to compensate for this. You must also be mindful not to discriminate against your employees. Discrimination based on one of the protected characteristics is illegal in employment law and could result in a discrimination claim at an employment tribunal. The protected characteristics include:

- race;

- age;

- gender;

- sexual status;

- marital status;

- disability;

- gender reassignment;

- religion or belief; and

- pregnancy and maternity.

You will also have to ensure that you consider specific laws relevant to performance-related pay, which include the:

- National Minimum Wage Act 1998; and

- National Living Wage Act 2016.

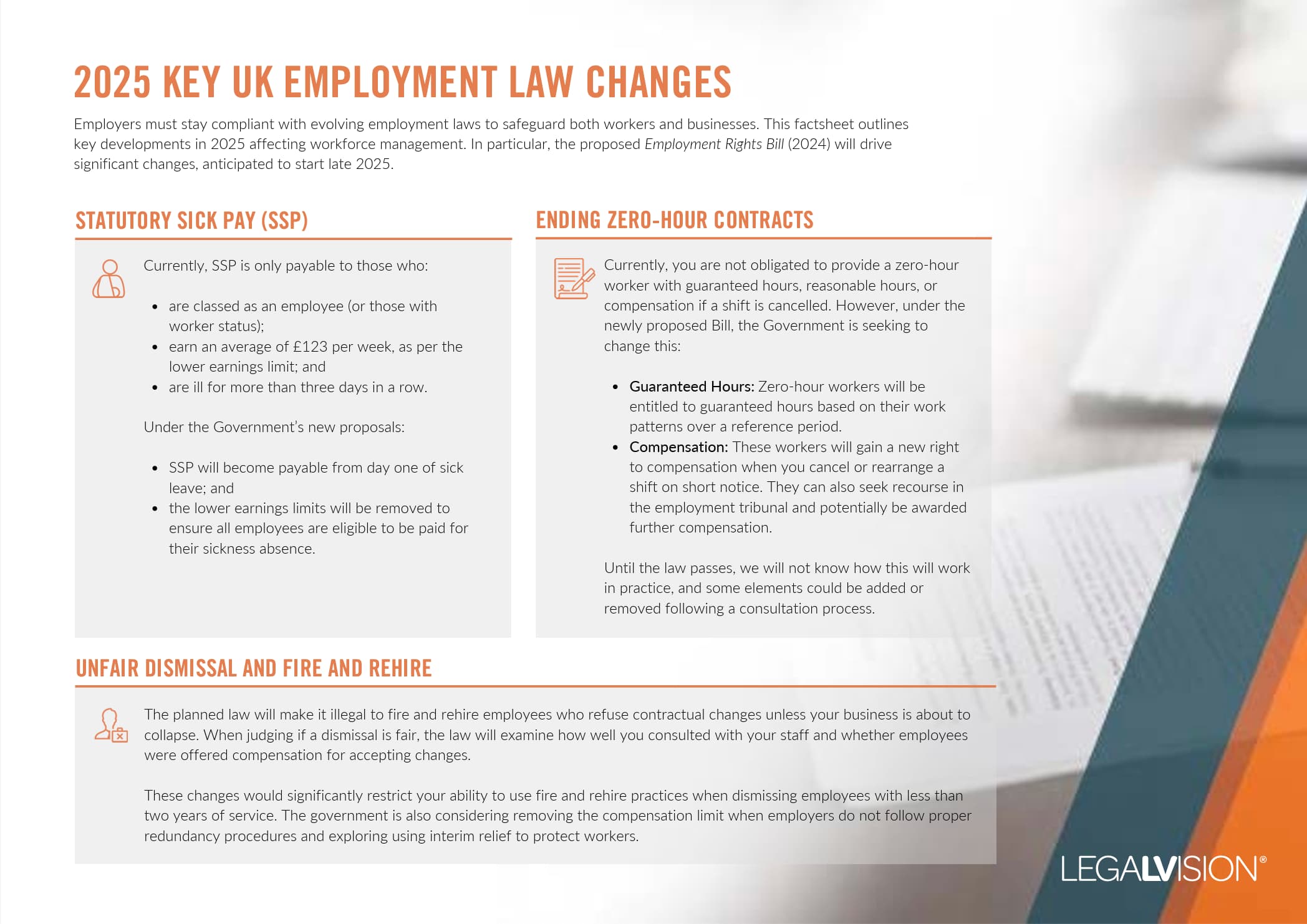

This factsheet outlines key developments in 2025 affecting workforce management.

Ensuring You Make Payments

A further legal consideration when implementing this system is to ensure you honour the payments you promise to make. If you include the performance-related system in your employee contracts, not paying when you should is a breach of contract. You could also breach the law as you could be making an unlawful deduction from wages.

If your employee feels forced to leave your business because you have not paid them their salary, which includes any performance-related pay, you could face a tribunal claim for constructive dismissal.

Other Considerations

In addition to the legal considerations listed above, there are other considerations when implementing a performance-related system that helps you comply with the law and encourage good practice. This includes setting fair and achievable standards for your staff. When you implement performance-related pay, it is also helpful to write a policy to ensure employees know what is expected of them.

It is also essential to keep good records when you implement performance-based pay. This helps reduce the risk of financial problems, allowing you to budget and reduce your business’ risk of debt.

Key Takeaways

Performance-related pay is where you offer your staff additional remuneration to reward them for good work or reasonable efforts. This may be short-term, such as a bonus, or long-term, such as shares. Employers like you may implement performance-based pay because, for example, they want to ensure staff commitment. If you implement a performance-related policy system, you must consider the legal issues affecting it. For instance, you must ensure it does not discriminate against staff based on the protected characteristics. You must also ensure you do not deduct from their normal wages to compensate for it. A further consideration is ensuring you make the payment you commit to, or you could be in breach of your employment contracts.

If you need help understanding the legal considerations when implementing performance-based pay in the UK, our experienced employment lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 0808 196 8584 or visit our membership page.

Frequently Asked Questions

Performance-based pay is additional pay to an employee’s normal pay and rewards them for performing well or trying hard.

There are various legal considerations when implementing your pay system, such as ensuring that you do not discriminate against your employees.

We appreciate your feedback – your submission has been successfully received.