In Short

- Employees work under an employment contract with benefits, while contractors operate independently without statutory entitlements.

- Employees follow set hours and use employer-provided tools, whereas contractors have more control over their work.

- Misclassifying an employee as a contractor can result in fines and backdated tax payments.

Tips for Businesses

Review working relationships regularly to ensure correct classification. Clearly outline employment status in contracts and consult legal professionals to avoid misclassification risks.

Understanding the distinction between employees and contractors is crucial for business owners to comply with employment laws and avoid costly penalties. Misclassifying workers can lead to fines, backdated tax payments and even criminal prosecution by HM Revenue and Customs (HMRC). Distinguishing an employee from a contractor is not always straightforward, especially given today’s flexible working arrangements that can blur the lines. This article breaks down the key factors you need to evaluate to determine whether a staff member truly qualifies as an employee or a self-employed contractor under the law.

What is an Employee?

Under UK law, if an individual works under an employment contract with you, they are considered an employee and have significant rights and protections. As their employer, you must provide employees with statutory benefits like sick pay and minimum notice periods, and they have protection against unfair dismissal. You generally pay employees through PAYE, deducting their income tax and national insurance contributions. Additionally, employees typically work regularly set hours at your business unless they are on approved leave.

Other defining features of employees include that:

- you oversee and manage their workload, providing guidance on how to complete work and setting deadlines;

- they cannot substitute someone else to do their assigned duties;

- you must offer them paid leave entitlements such as sick days and maternity leave;

- they can join your company pension scheme;

- they must follow your company’s policies around disciplinary processes, grievances and redundancy procedures; and

- you provide the tools, materials and equipment for them to perform their work.

What is a Contractor?

A contractor works independently as a self-employed individual, providing services to your business under a commercial contract. Unlike employees, contractors maintain high autonomy and control over how and when they complete their work. They use their own tools and equipment and cover operating costs themselves. Instead of a salary, you pay contractors to complete specific projects, tasks, or agreed-upon services. Additionally, contractors are responsible for managing their own taxes and national insurance, and you do not provide employment benefits like paid leave or pensions.

Continue reading this article below the formCall 0808 196 8584 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

Key Differences

As a business owner, properly distinguishing between contractors and employees is essential to avoid unintentionally granting employment rights and responsibilities. With contractors, you benefit from significantly more flexibility. They determine which projects to accept from you and can delegate work to others. There is no obligation to provide set working hours or an ongoing work commitment or dictate how contractors carry out services. You can terminate contractor arrangements by simply ceasing to utilise their services without employment termination protocols.

However, this flexibility for you comes at the cost of contractors shouldering greater risks themselves. They are responsible for managing their tax affairs and business overheads without entitlement to employment benefits like paid leave or unfair dismissal protections. In contrast, you hire employees to work according to your instructions and schedules. Comprehensive employment rights established by law also apply to employees, such as:

- minimum wage;

- parental leave; and

- the ability to claim unfair dismissal against you.

The critical factor is ensuring your conduct toward contractors remains consistent with the terms of their engagements to avoid unintentionally creating an employment relationship. You must be mindful of:

- the degree of control exerted;

- where work is performed; and

- whose resources are utilised.

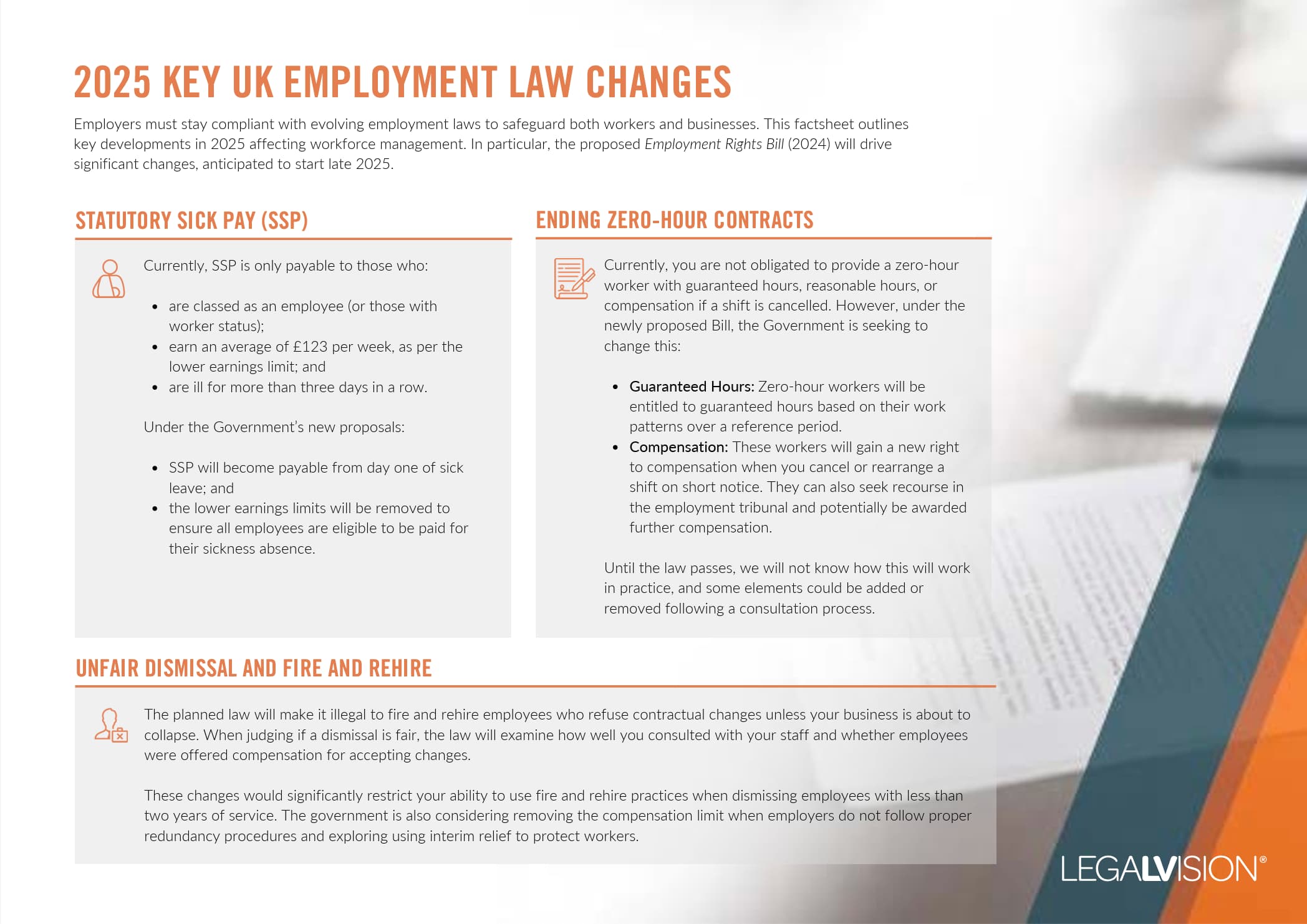

This factsheet outlines key developments in 2025 affecting workforce management.

Employee vs. Contractor Checklist

You must carefully consider the key factors distinguishing employees from contractors. Here are some common factors to assess:

| Employees | Contractors |

| You determine their work schedule and hours. You will usually pay them wages or an annual salary. | They decide their own schedules and working hours. There is no obligation for you to provide work and for them to accept. |

| They take direction and supervision from you and cannot substitute or delegate their work. You must also provide the tools and equipment for them to carry out their work. | They can delegate or substitute others to do the work. They also work autonomously with little supervision from you and use their own tools. |

| They are entitled to minimum wage, paid leave, parental leave, unfair dismissal protections and redundancy pay. You must also deduct taxes from their pay and provide employer national insurance contributions. | Contractors are not entitled to employee rights or benefits and are responsible for managing their own taxes. You do not have to pay employer national insurance. |

| You must follow proper procedures to terminate employment. | Either party can terminate the contract without proper notice, depending on what is included in the contract. Contractors have a limited level of integration into your business operations. |

Reviewing Workforce Relationships

Regularly reviewing your workforce relationships is crucial to avoid misclassifying individuals as contractors when they should be classified as employees under UK laws. Misclassification occurs when you incorrectly categorise your staff, such as treating an employee as a self-employed contractor. The consequences can be severe, ranging from:

- reclassifying the individual;

- paying employment benefits retroactively;

- facing financial penalties and fines; to

- criminal prosecution by HMRC.

Contractors also have the right to appeal their status. They can use HMRC’s Check Employment Status for Tax (CEST) tool to assess if you have misclassified them. Those found to be employees can then contact HMRC or the Employment Tribunal to resolve the dispute. Given the high legal and financial risks of misclassification, it is essential for you as a business owner to regularly audit employment relationships against the determinant factors. Ensuring staff are properly classified based on duties, obligations and working arrangements can prevent harsh penalties.

Key Takeaways

To decide whether your workers are employees or contractors, you should consider the true nature of the working relationship, not just contract terms. Employees tend to work under closer supervision and control from you, while contractors work autonomously. Additionally, contractors shoulder financial risks, cover overheads and are not entitled to employment benefits. Misclassification can expose you to substantial penalties from HMRC and employment tribunal claims. You can avoid misclassification by conducting regular audits of roles against employment status factors.

If you need help classifying your staff, our experienced employment lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 0808 196 8584 or visit our membership page.

Frequently Asked Questions

Review working arrangements regularly against criteria such as control, integration, substitution rights, and pay structures. Ensure actual practices match stated employment terms.

Misclassifying employees as contractors can result in liabilities for backdated holiday pay, tax contributions, HMRC fines, and claims of employment rights violations.

We appreciate your feedback – your submission has been successfully received.