In Short

- A demerger separates one business into two or more independent companies to improve focus, manage risk, and support growth.

- Different structures apply, with potential tax benefits, but strict legal and tax requirements must be met.

- Careful planning is essential, particularly around assets, employees, contracts, and compliance.

Tips for Businesses

Before starting a demerger, review how key assets, staff, and contracts will be divided, and check for any change of control clauses. Consider the tax and funding implications early and seek legal and tax advice to manage risk, control costs, and ensure the restructure supports your long-term business goals.

What is a Demerger?

A demerger is a corporate restructuring process where the business of a company is split into two or more trading companies. Demergers are used by companies of all sizes to realise business aims. As a general rule, the larger the company, the more complex and time-consuming the demerger process will be. However, a demerger can help a business hit its long-term aims and improve efficiency.

A company may decide to demerge parts of its business for a number of commercial reasons, including:

- to compartmentalise and mitigate risk posed in different ventures through a group company structure;

- to improve its tax position;

- to prepare parts of the company to be sold; and

- to separate parts of the company ahead of offering employees Enterprise Management Incentive (EMI) options.

When you incorporate a company in England and Wales, you must maintain a number of company registers at its registered office or at the Companies House. This template includes these company registers.

Types of Demergers

There are a number of different types of demergers. The most common are:

- capital reduction demergers; and

- statutory demergers.

Capital Reduction Demerger

Capital reduction demergers can be used within group structures where a parent company is unable to either:

- pay a dividend to shareholders; or

- the company does not want to reduce its distributable reserves.

A new company will be set up (with the same shareholders but outside of the group), with the group transferring assets to the new company. The new company will then pay for the assets by issuing shares to the shareholders.

Statutory Demerger

The term ‘statutory demergers’ encompasses a number of different types of demerger providing they satisfy the relevant legal and tax requirements. This includes:

- direct demergers; and

- indirect demergers.

However, statutory demergers may qualify for tax exemptions. If a demerger meets certain criteria, the company and shareholders can enjoy tax breaks relating to:

- income tax;

- capital gains tax;

- exit charges;

- stamp duty; and

- value added tax (VAT).

An Example

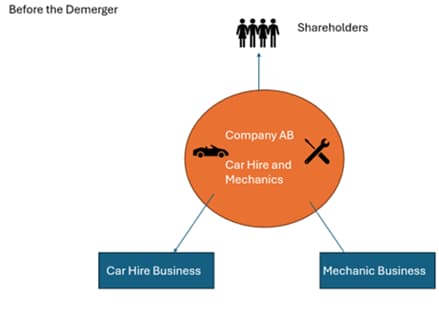

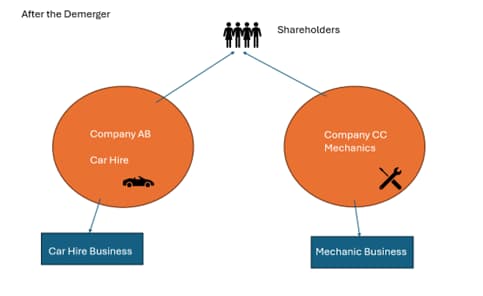

When a company has two types of trade operating through one company, it may decide to demerge the two trades. Additionally, the directors and shareholders will incorporate a new company and transfer the assets and liabilities of one trade to the new company.

In the example below, Company AB runs a garage providing mechanic services and also provides car hire services. Each venture poses different risks, and the shareholders have decided to undertake a demerger to split the two ventures.

A new company has been created with the same shareholders and directors, with assets relating to the mechanics venture transferred to the new company. Following the demerger, the companies are not part of a group structure as they are not owned by the same holding company.

Call 0808 196 8584 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

Key Considerations for a Demerger Process

When considering undertaking a demerger, you must also consider which business assets will be owned by each company. You will need to assess which assets are needed by each company to carry out its business. Assets can include, but are not limited to:

- tangible objects, such as machinery, tools and property;

- staff contracts, such as employees, workers and contractors;

- intellectual property licences;

- regulatory licences; and

- client and supplier contracts.

Moreover, directors and shareholders of a company should consider their tax position before a demerger and how the proposed demerger will impact this. They should also consider how the demerger will impact revenue and growth opportunities for each company post-completion.

The company should look at key contracts with suppliers embedded within their supply chain and with clients that make up a significant portion of their revenue stream. Some contracts may contain change of control provisions that can give the other side a right to terminate the contract where a company has undergone a restructure or change of control.

Advantages of a Demerger

Demergers can create additional shareholder value as the shareholders will acquire shares in a separate company. Providing both companies perform well, the shareholders can receive dividends from both and see the share market value of both companies rise.

Following a demerger, specialist teams will be split up. This can increase accountability and incentivise staff to boost revenue growth.

Disadvantages of a Demerger

Demergers are complex restructures that require the expertise of numerous professional advisors, such as lawyers and accountants. Depending on the size and complexity of the restructure, costs can easily spiral out of control.

In addition to costs, undertaking a demerger can take up a lot of the time of the senior management of the company. This is time that could be spent pursuing business aims. A company should only undertake a demerger if it is absolutely necessary to achieve its business objectives.

Key Takeaways

While demergers can offer significant strategic advantages to small businesses, they are complex processes that require careful planning and execution. Companies considering a demerger should weigh the potential benefits against the costs and challenges involved. Seeking professional advice from legal and financial experts is crucial to ensure a successful and compliant demerger process.

LegalVision provides ongoing legal support for small businesses through our fixed-fee legal membership. Our experienced lawyers help businesses manage contracts, employment law, disputes, intellectual property and more, with unlimited access to specialist lawyers for a fixed monthly fee. To learn more about LegalVision’s legal membership, call 0808 196 8584 or visit our membership page.

Frequently Asked Questions

A demerger allows a business to separate different activities into standalone companies. This can reduce risk, improve focus, make parts of the business easier to sell or grow, and potentially deliver tax and shareholder value benefits.

You should assess how assets, employees, and key contracts will be divided, understand the tax implications, and check whether any agreements contain change of control clauses. It is also important to seek legal and tax advice to ensure the process is compliant and commercially effective.

We appreciate your feedback – your submission has been successfully received.