In Short

- Off-payroll working (IR35) applies when a business engages a worker through an intermediary like a personal services company (PSC).

- Employers must assess if the individual would be classed as an employee for tax purposes and follow PAYE rules accordingly.

- Non-compliance can result in penalties, and guidance is available from HMRC’s CEST tool.

Tips for Businesses

Consult professional advice to accurately assess employment status under IR35. Review contracts, assess control over workers, and ensure compliance to avoid fines.

Running a business usually requires staff members to help you carry out your business activities. You will usually employ workers as your employees, but sometimes, you may have staff members providing you with off-payroll services to save your company employment taxes. However, there are rules about this which you need to be aware of. This article will, therefore, explain off-payroll working in terms of legal implications for employees and contractors.

What is Off-Payroll Working?

Off-payroll working is when an employer asks an individual to work for you through an intermediary. Off-payroll means you do not pay the individual through your usual Pay As You Earn (PAYE) system. This means you save employment tax and do not need to pay your employer’s National Insurance Contributions (NICs). These are currently at 13.8%.

The intermediary used when engaging in off-payroll work is usually a company, which is a ‘personal services company’ (PSC). These intermediaries are also utilised when businesses like yours work with contractors. There is no legal definition for a personal services company, but usually it:

- is a company consisting of one employee or office holder; and

- has the sole purpose of offering business to the series and individuals.

What are the Off-Payroll Working Rules?

The off-payroll working rules are the rules that apply when you ask individuals to work off-payroll for your business. You will hear people refer to these as IR35. They are predominantly in place to ensure that PSCs are not in place so you, as an employer, are not wrongfully avoiding employment taxes.

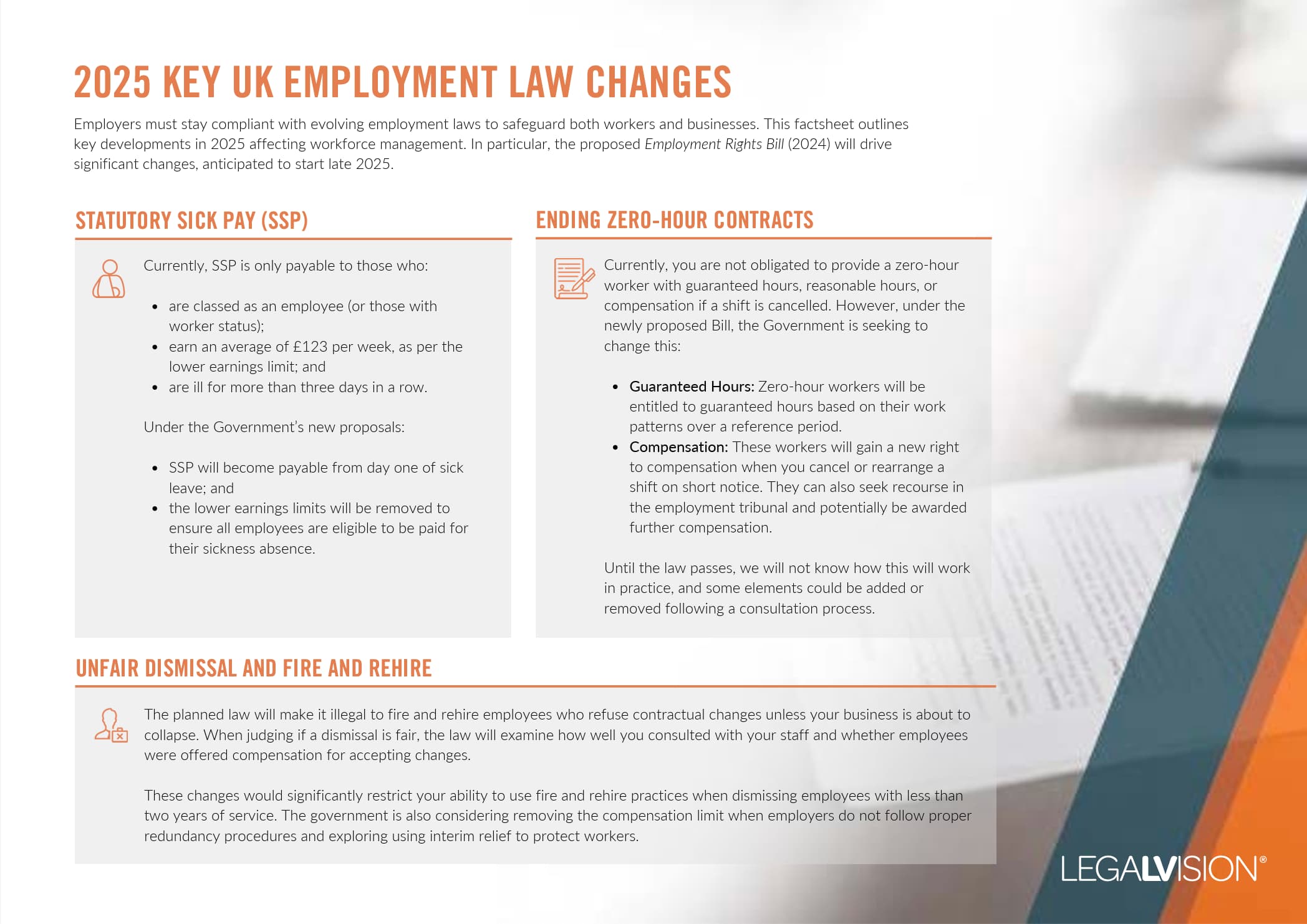

This factsheet outlines key developments in 2025 affecting workforce management.

Therefore, the IR35 rules say that if the individual was working directly for your business, they would have been considered an employee for the purposes of employment tax; you should tax them as such. This includes if they were working as a business director or office holder.

Continue reading this article below the formHow to Determine if a Person is an Employee for Tax Purposes

Your duty as an employer is to determine whether the individual engaging in off-payroll work would be an employee for tax purposes if they worked with you directly. If so, they fall inside IR35. As the ‘client’ engaging with the individual through a PCS, you should decide by issuing them a status determination statement (SDS) stating your decision and why to the person providing services.

However, if you engage the services of an individual through an intermediary but indirectly, the rules are different. For example, you may have someone providing your business services through a recruitment agency who found them through an intermediary PSC. If so, the recruitment company must deduct tax through PAYE and pay the NICs. They are, therefore, the ‘fee payer’.

However, if you are a small private business engaging the services of someone through a PSC, it is not up to you to decide if they fall inside IR35. Instead, it is the responsibility of the PSC to determine this and pay any taxes.

However, certain factors are taken into account, such as:

- how much control your business has over the worker;

- if the worker is a business; and

- the level of integration of the worker in your business.

To help you determine this without a test, HMRC has published the guidance ‘Check Employment Status for Tax (CEST)’.

Key Takeaways

If an individual provides services to your business but not on PAYE, they are an off-payroll worker. This means they are supplied to you through an intermediary, usually a personal services company (PSC), and you do not pay their PAYE or NICs. This means that the IR35 or off-payroll rules apply to you to ensure you are fairly not paying this tax.

You must pay the tax if, in the situation, the person concerned is working directly for you; they would be considered an employee, director, or office holder. It is usually your duty as an employer to determine this, yet there is no legal way to decide this. Instead, different factors are looked at. For example, how much control does your business have over the individual concerned? However, HMRC does provide guidance on this, which is the Check Employment Status for Tax (CEST).

If you need help understanding the legal implications of off-payroll working in the UK, our experienced employment solicitors can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. So call us today on 0808 196 8584 or visit our membership page.

Frequently Asked Questions

Off-payroll working is when a business owner engages the services of an individual through an intermediary, usually a personal services company (PSC).

The IR35 rules or off-payroll working rules are the rules about off-payroll working.

We appreciate your feedback – your submission has been successfully received.