As a small business, when you begin employing staff, your business costs increase as you pay them wages. When working for you, your employees have many legal rights, including your legal obligations towards their health and safety at work. When your employees are sick and unable to work, you have a legal duty to pay them Statutory Sick Pay (SSP) on their non-working days at a specific weekly rate. You must be aware of the rules regarding SSP to avoid underpaying your employees and facing potential legal action. This article will explain what small businesses need to know about SSP changes.

What is Statutory Sick Pay?

SSP is the minimum amount of sick pay you as an employer must pay your employees where they meet the criteria. Of course, you can pay them more than this; if so, your employment contracts will detail this. For example, you may offer your staff a sick pay scheme, which you may also refer to as an occupational scheme. You should note that if you are a business in the agricultural industry, the rules of SSP vary for your agricultural workers.

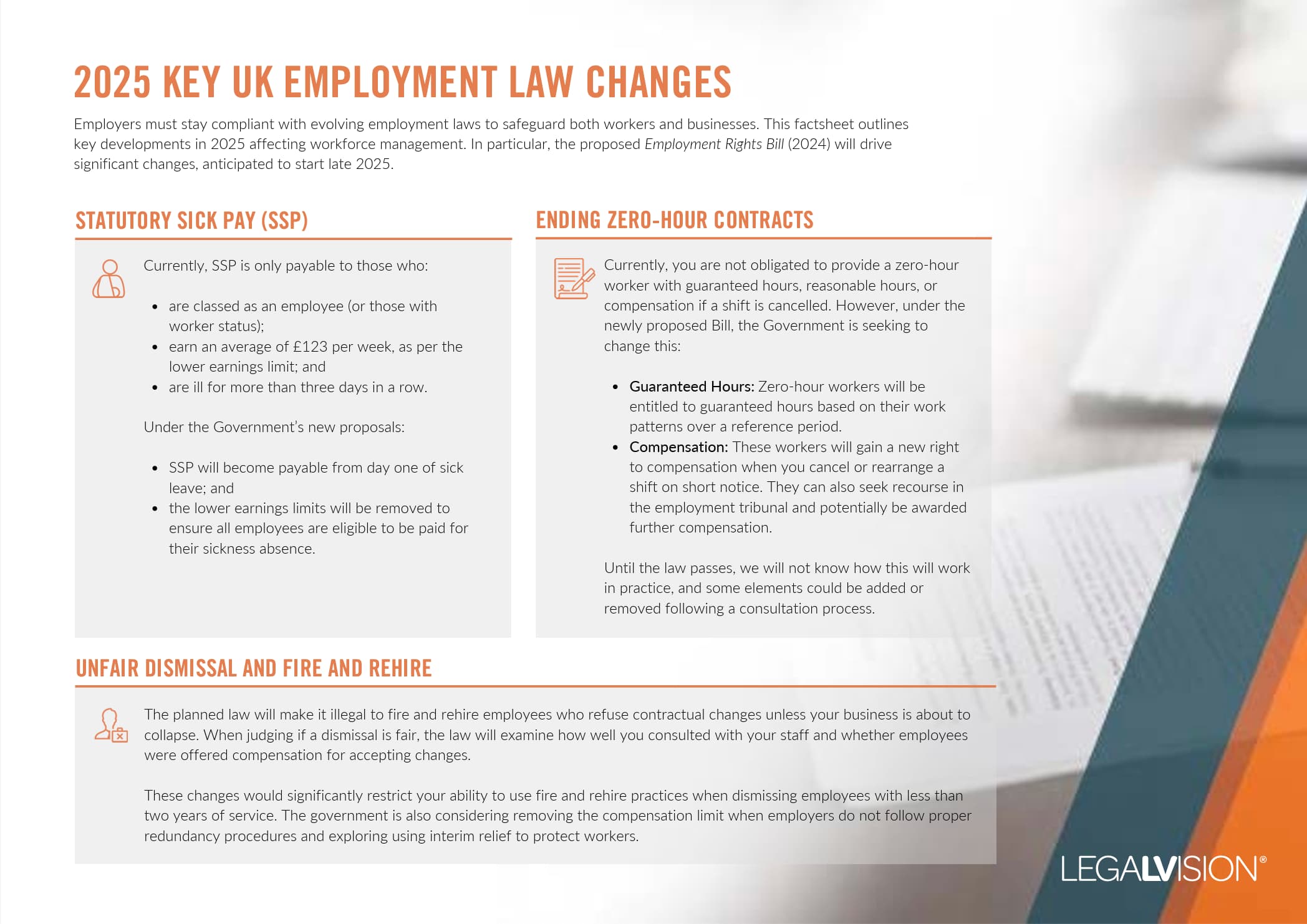

This factsheet outlines key developments in 2025 affecting workforce management.

What Do I Need to Know About Statutory Sick Pay Changes?

As an employer, you must be aware of any changes to SSP. Not complying with any changes means you are not abiding by employment law. The type of changes that occur can vary and will often happen with the new tax year in April. For example, changes to SSP could include the:

- amount you have to pay your employees; or

- criteria to say who is eligible for SSP.

From April 2024, your employee’s entitlement to SSP changed in terms of the amount you must pay. The rate of SSP increased from £109.40 to £116.75 per week. Therefore, you pay this entitlement to any of your employees who:

- have been sick for at least four days in a row;

- cannot work as a result of the above, and

- earn at least £123 per week before tax.

Additionally, more changes could occur in the future. The Work and Pensions Committee recently compiled a report that suggested further changes. These include that:

- SSP should be the same rate as Statutory Maternity Pay (SMP); and

- no matter your employees’ pay rate, you must pay them SSP.

Although these changes have not yet occurred, they demonstrate that the SSP scheme can develop constantly, so you should remain up-to-date with your obligations.

Continue reading this article below the formHow Can I Ensure My Business is Aware of Statutory Sick Pay Changes?

Ultimately, to ensure you and your employer know about any changes to SSP, you should take legal advice from an employment lawyer. However, you can keep yourself informed. Where changes to SSP occur, you should review your employment policies and update them accordingly. Ensuring that your payroll staff has the proper training to understand any SSP changes is also helpful.

As an employer, you must communicate any SSP changes to your staff so they know their legal rights.

Key Takeaways

When you employ staff who are sick and unable to work, you will have to pay them SSP. Additionally, your business may offer employees more than SSP through a staff sick pay scheme. It is possible for changes to occur to SSP, such as the amount and the qualifying criteria. For example, in April 2024, the amount increased to £116.75 per week. Employment law changes often, so you must keep up with changes such as those to SSP. An employment lawyer can help you do this, and you should notify staff and workers when changes occur.

If you need help understanding SSP changes in the UK, our experienced employment lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 0808 196 8584 or visit our membership page.

Frequently Asked Questions

SSP is the pay your employees may be legally entitled to when they are sick and off work for four days or more consecutively.

A recent change to SSP occurred in April 2024, when the rate rose to £166.75 per week.

We appreciate your feedback – your submission has been successfully received.