In Short

- Employment Allowance helps reduce National Insurance contributions, saving up to £5,000 annually.

- To be eligible, your business must meet certain conditions, including National Insurance liabilities under £100,000.

- Claims are made through your Real Time Information (RTI) submission to HMRC and must be renewed each year.

Tips for Businesses

To claim Employment Allowance, ensure your eCommerce business meets eligibility criteria, such as having less than £100,000 in National Insurance liabilities. Use your payroll software to indicate your claim through the RTI submission. Review your eligibility annually to keep reducing your National Insurance costs effectively.

As an eCommerce business owner, you will likely be looking for ways to save your business money. For example, you may try to find a more affordable stockist of the goods you sell online. If you are a small employer, your eCommerce brand may be able to save money through Employment Allowance if you meet the legal requirements. This article explains Employment Allowance and whether your eCommerce business will likely be eligible.

What is Employment Allowance?

Employment Allowance is in place to help small businesses like your internet brand as it helps reduce your employment costs, such as your annual National Insurance liability.

You cannot include some particular employees in your employment allowance claim. These include:

- those you employ as domestic, household or personal workers such as a nanny; and

- employees whose wages are covered by IR35 ‘off-payroll working rules’.

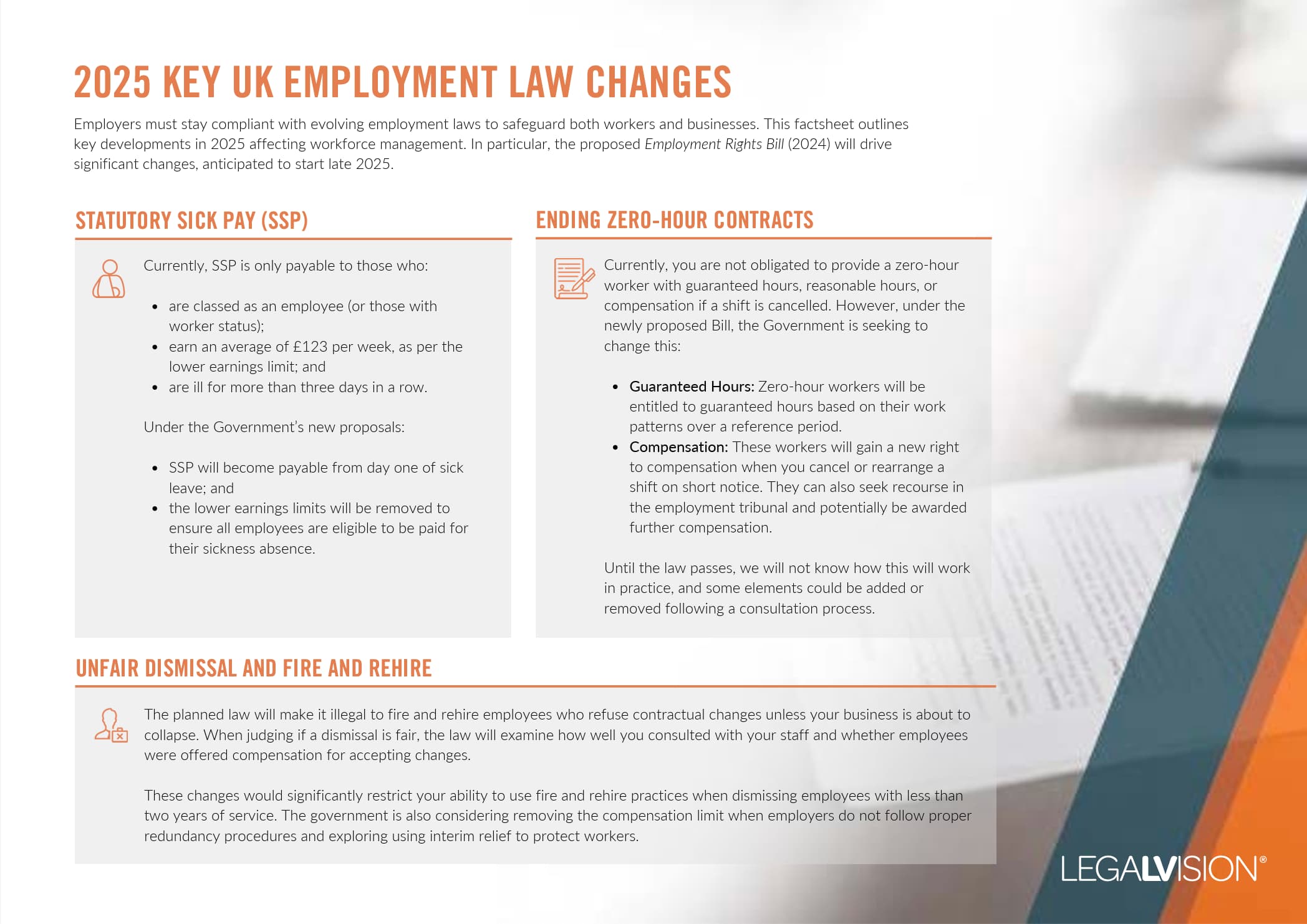

This factsheet outlines key developments in 2025 affecting workforce management.

Am I Eligible for Employment Allowance?

Your eCommerce brand may be eligible to claim Employment Allowance if it is registered as a:

- sole trader;

- partnership; or

- limited company with two or more directors earning over the secondary threshold for Class 1 National Insurance contributions.

If you meet this criteria, you will be eligible for Employment Allowance if your Class 1 National Insurance liabilities were less than £100,000 during the previous tax year. There are some essential points to note about this figure:

- If your business is part of a group of companies or charities, this figure applies to the overall liabilities for the whole group.

- If your business has more than one payroll, so more than one employer PAYE reference, the figure applies to both payrolls, and you can claim only against one of these.

- ‘Deemed payments’ are not part of the £100,000 threshold, which is payments to off-payroll workers such as contractors.

Another way your internet brand may be eligible is if you employ either a:

- care worker; or

- support worker.

Where you employ one of the above, it does not matter if they are domestic, household or personal workers who would usually not be included in the claim.

Continue reading this article below the formCall 0808 196 8584 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

How Can I Claim Employment Allowance?

To claim Employment allowance, you need to complete part of the Real Time Information (RTI) submission to HM Revenue and Customs (HMRC). You can do this at any time during the tax year in question. Each of your National Insurance contributions will then be reduced until the £5000 allowance has been used.

To claim employer allowances next tax year, you must apply again and check if you are still eligible.

Key Takeaways

If you employ staff, you may be eligible for Employment Allowance. This is an allowance of £5000 to reduce your Class 1 National Insurance contributions. However, your Class 1 National Insurance liabilities must have been less than £100,000 in the previous tax year. You can claim Employment Allowance through your Real Time Information (RTI) submission to HMRC, and the exact way you indicate you are applying for Employment Allowance depends on the payroll software you use. When you claim Employment Allowance, you need to do so on a yearly basis.

If you need help claiming Employment Allowance, our experienced eCommerce lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 0808 196 8584 or visit our membership page.

Frequently Asked Questions

Employment Allowance is a way to reduce your employment costs by reducing your National Insurance liability.

A limited company with two or more directors earning over the secondary threshold for Class 1 National Insurance contributions may be able to claim Employment Allowance.

We appreciate your feedback – your submission has been successfully received.