On this page

- About This Guide

- Choosing Your Business Structure

- Complying with Legal Rules

- Key Agreements, Contracts and Policies

- Construction-Specific Contracts

- Standard Form Construction Contracts

- Customising Your Contract

- Key Clauses in Construction Contracts

- Warranties and Guarantees

- Insurance Policies

- Providing a Safe Workplace

- Data Breach Actions

- Checklist: Essential Legal Tasks

About This Guide

Ensuring your business has a strong legal foundation is essential if you want to succeed in the UK’s competitive construction market.

The UK’s multi-billion-pound construction sector is strategically important for the economy as a whole and, in particular, for the housing, infrastructure, and job markets. Businesses operating in this industry can face pressure to complete projects quickly, while managing complex legal requirements and safety risks, alongside growing scrutiny of issues such as climate change and environmental protection.

Construction is a high-risk, heavily regulated industry with significant legal considerations. For instance, projects can be complex with many moving parts, strict regulatory rules, and multi-tiered contractual arrangements. It is also an industry where cash flow is critical.

Given the inherent risks in the construction industry, having a strong legal foundation is essential. This guide provides clear and practical legal insights tailored for UK construction business owners and operators.

Running or starting a UK construction business? Download this free guide to stay compliant with legal requirements, contracts, and safety standards.

Choosing Your Business Structure

Whether you are launching a new business or managing an established company, having the right structure in place is crucial for long-term success. It can significantly impact your legal and operational risks, asset protection, tax obligations, legal costs, and public perception.

Most Common Business Structures in the UK

The construction industry often involves high-value and high-risk projects, making it crucial to choose an appropriate business structure. You should consider that:

- limited company structures provide limited liability protection, essential for managing risks like delays and defects;

- joint ventures, often structured as Special Purpose Vehicles (SPVs), help ringfence risks for large-scale developments;

- professional services providers, like engineers or architects, may prefer LLPs for both limited liability and flexible internal management; and

- parent companies may offer performance guarantees for subsidiaries, ensuring the employer/client has recourse if the contractor defaults.

Always seek legal advice before providing such guarantees for your specific circumstances.

Types of Business Structures

The table below summarises the key features of each structure. It is essential to seek both legal and tax advice to determine the most suitable business structure.

| Cost to Establish | Risk of Liability | Tax | |

| Private Limited Company | Medium. You must register with Companies House, sign up for Corporation Tax and develop Articles of Association. You may also register for VAT and develop a Shareholder Agreement. | Limited liability will protect shareholders from personal responsibility for company debts. However, directors must follow their duties or risk fines, prosecution, or disqualification. | The company will pay Corporation Tax (at a rate based on its profit). Tax will also be due on dividends received by shareholders and on income tax for employees and office holders. |

| Sole Trader | Low. You must notify HMRC if you pay tax and file yearly returns. You may also need to register for VAT. | As a sole trader, you will be personally liable for any debts the business incurs. | You will be taxed directly at your income tax rate, with national insurance contributions also payable. |

| General Partnership | Low. A nominated partner will register the partnership with HMRC and file its tax return. You will need a Partnership Agreement and may need to register for VAT. | Partners will be jointly and severally liable for the partnership’s debts. Each partner can be sued in their personal capacity. | All profits from a partnership will be taxed at each individual partner’s income tax rate, with national insurance also payable. All partners will file individual returns. |

| Limited Liability Partnership | Medium. You must register your LLP with Companies House. Partners should also enter an LLP Agreement to set out the terms of the partnership. | Each partner’s liability will usually be limited to their investment. Members are not liable for partnership debts unless stated in the LLP Agreement. | Each member will be taxed on their profit share as personal income, with each member responsible for their own tax and national insurance contributions. |

Call 0808 196 8584 for urgent assistance.

Otherwise, complete this form, and we will contact you within one business day.

Complying with Legal Rules

The UK construction industry operates under strict legal frameworks. Your business must seek legal advice early in the planning process to understand the specific legal rules and obligations that apply to your construction project. Key laws relevant to this industry include, but are not limited to, the following:

Legislation | Description |

| Construction (Design and Management) Regulations 2015 (known as the CDM Regulations) | The CDM Regulations apply to most construction projects in Great Britain and outline the health and safety duties of clients, designers, and contractors. Where a project involves more than one contractor, two statutory roles must be appointed: + Principal Designer: Oversees health and safety during the design phase. + Principal Contractor: Manages health and safety during the construction phase. The Principal Contractor is usually the head contractor. The Principal Designer may be an architect or, in a Design & Build project, the contractor. |

| Housing Grants, Construction and Regeneration Act 1996 (known as the Construction Act) | The Construction Act outlines payment terms and gives the right to resolve disputes through adjudication in most business-to-business and business-to-consumer construction contracts (except for residential occupiers). If a contract does not follow the Act’s requirements, key payment and adjudication terms will be automatically included. Adjudication offers a quick and affordable means of settling disputes while work is ongoing. |

| Building Regulations (under the Building Act 1984) | This Act requires that all building work meet minimum technical and safety standards. |

| Building Safety Act 2022 | Those responsible for higher-risk buildings must manage safety risks throughout the building’s lifecycle. |

| Construction Industry Scheme (under the Income Tax (Earnings and Pensions) Act 2003 (known as the CIS) | This Act outlines the rules governing how contractors must deduct tax from subcontractors and report payments to HMRC. Contractors need to be registered through the CIS. |

| Procurement Act 2023 | Under this Act, public-sector organisations must award construction contracts fairly and transparently, following established procurement principles and rules. |

It is also vital to ensure you obtain any necessary planning permissions, licences or permits before starting construction. Some projects may additionally require environmental impact assessments or need to meet sustainable development obligations.

Key Agreements, Contracts and Policies

In addition to contracts for specific construction projects, it is essential to have other legal agreements in place to mitigate your risk and protect your business.

The table below provides an overview of some essential agreements, their primary purposes, and key features. By familiarising yourself with these agreements, you will be better equipped to navigate the legal aspects of your business dealings and protect your interests.

| Shareholder Agreement | Sets out the relationship between the company and its shareholders | + Decision making + Pre-emption rights + Confidentiality and restrictions + Shareholder death or bankruptcy + Drag and/or tag along rights |

| Articles of Association | A mandatory constitutional document governing how a company is run | + Can be bespoke or Model Articles + Decision-making and director powers + Share structures + Shareholder rights |

| Supplier Agreement | Governs the relationship between suppliers (of goods or materials) and your business | + Payment terms + Delivery schedules + Quality standards + Warranties and indemnities + Dispute resolution mechanisms + Termination rights |

| Confidentiality Agreement (NDA) | Protects confidential information disclosed during business dealings | + Defines what confidential information is + Purpose of the sharing or confidential information + Disclosure restrictions and permissions + Obligations to secret information + Timeframes for confidentiality + Procedures for returning confidential materials + Consequences for breach of confidentiality |

| Privacy Policy | Explains how your business processes personal information, which is mandatory for controllers under UK data protection law and often published on a website | + Types of personal information processed + Methods of collection + Lawful basis for processing + Data subject rights + Third-party data sharing |

Additionally, you will need employment and contractor agreements, as well as other policies, which are outlined below in this Guide.

Construction-Specific Contracts

Construction projects, by their nature, are risky and often involve substantial investment and multiple stakeholders. It is essential to have contracts in place to limit or mitigate your risk and to protect your business. Having clear contracts in place can ensure a smooth relationship with clients and others in the supply chain (including subcontractors and subconsultants).

Contractual Issues

Well-drafted construction contracts can help to manage these risks by clearly defining each party’s roles, rights and obligations.

Drafting Construction Contracts

To determine the type of contracts you require, it is essential to understand your procurement method and establish your risk allocation strategy. Construction projects can involve various procurement methods. Two of the most common methods are:

- Design and Build: The contractor is responsible for both designing and constructing the works. If there are defects or omissions in either the design or construction, the client can pursue a claim against the contractor alone. Where the client initially engaged architects or engineers, those contracts are usually novated (transferred) to the contractor.

- Construct Only: In this approach, the contractor is only responsible for the construction phase. The client engages design consultants, such as architects or engineers, separately to prepare the design. If problems arise with the design, the client claims against the relevant consultant. If issues arise with the build quality or workmanship, the client claims against the contractor.

Construction projects typically involve multiple contracts due to the number of parties involved. Typically, a project may involve:

- the construction contract between the client and contractor;

- subcontracts between a contractor and its subcontractors;

- consultancy agreements between a client and design consultants;

- agreements with funders;

- parent company guarantees (usually given by a parent company to a client to guarantee the contractor’s performance of the works); and

- collateral warranties (given by subcontractors in favour of a client or funders or other parties involved in a project).

Standard Form Construction Contracts

UK standard-form contracts provide a reliable contractual framework for many construction projects (typically medium to large-scale projects). These contracts are well-known and used in the market as a starting point for contractual negotiations.

The most commonly used standard forms include:

- JCT Contracts: This suite of contracts is widely used in medium to large-scale projects. They tend to be lengthy and are less suitable for smaller projects; and

- NEC Contracts: These forms are popular in the public sector and infrastructure projects.

Customising Your Contract

Key Clauses in Construction Contracts

If you work in the building and construction industry and receive or prepare a construction contract, it is essential to know which clauses to look out for and why. Five key clauses typically found in construction contracts are outlined below.

| Indemnities An indemnity makes one party responsible for covering the other’s losses. Construction contracts often include indemnities for:death or personal injury;property loss or damage;infringement of intellectual property rights; andbreaches of law, such as H&S. Indemnities can extend liability beyond what the law requires and may lead to uninsured losses. If the indemnity is not market-standard, you should consider asking for it to be removed. | Liability Caps Contractors usually try to cap their liability to a set amount or percentage of the contract value. Principals may also have a liability cap. Caps may exclude (or “carve out”) certain losses, such as:insurance proceeds; personal injury or death; IP infringement; and fraud, misconduct, or gross negligence. If you are a contractor, having a cap is important. If you are a principal, you may want to exclude certain serious breaches from the cap. |

| Force Majeure A force majeure clause covers events beyond a party’s control that prevent them from meeting contract obligations, such as natural disasters or pandemics. It can excuse non-performance of certain obligations and may allow time extensions. | Consequential Loss Consequential losses are indirect losses, such as:lost profit or revenue; lost opportunity or contracts; and reputational damage. Construction contracts often exclude both parties’ liability for these types of losses. If you are a contractor, broader exclusions are usually better. Principals may prefer a more limited exclusion to preserve rights. |

| Complete Pre-Settlement Tasks Warranties are promises that certain facts are true or that future actions will be taken. Clients may require contractors to warrant that works are:fit for purpose; legally compliant; and completed to good standards and on time. Breach of warranty can lead to claims or additional legal remedies. Even if not stated in the contract, some warranties may be required by law. |

Warranties and Guarantees

Collateral warranties and parent company guarantees (PCGs) are mechanisms used in construction projects to provide additional protection and security. Collateral warranties link third parties directly to contractors, while PCGs ensure the contractor’s obligations are backed by its parent company’s assets.

| Name | What It Is | What It Does |

| Collateral Warranties | A contract that links a client or third-party beneficiary (such as a purchaser, construction site funder) with a contractor, subcontractor, consultant, or designer. This is typically used in large construction projects. | Protects third parties by ensuring they have direct legal recourse against contractors or subcontractors, especially if the head contractor becomes insolvent or ceases business. It creates a safety net for clients or buyers in construction projects. |

| Parent Company Guarantees (PCG) | A contractual commitment made by a contractor’s parent company to guarantee the contractor’s obligations under a building contract. This is provided alongside the contractor’s entry into the main contract. | Provides additional security and comfort to the client, primarily when the contractor operates with minimal assets in the subsidiary company. It is used to ensure the parent company remains liable if the subsidiary fails to meet its obligations. It therefore protects small businesses from increased liability. |

Insurance Policies

Insurance is essential for managing risk in any commercial arrangement, particularly on construction projects, given their inherently high-risk nature.

An ‘all risks’ insurance policy will provide comprehensive cover for your construction project, and often involves a bundling of contract works insurance and public liability insurance. Other types of insurance include:

- Contract Works Insurance: Covers loss, damage or destruction of work in progress on a construction site.

- Professional Indemnity Insurance: Covers liability arising from professional negligence, such as negligent design errors.

- Public and/or Product Liability Insurance: Provides cover against liabilities arising from personal injury to third parties and damage to property resulting from works carried out and/or products supplied.

- Employers’ Liability Insurance: Provides cover against injury or illness to employees arising from their employment. This is a mandated policy by law.

- Latent Defects Insurance: Provides longer-term cover, typically protecting the building owner against material building damage that becomes apparent after completion.

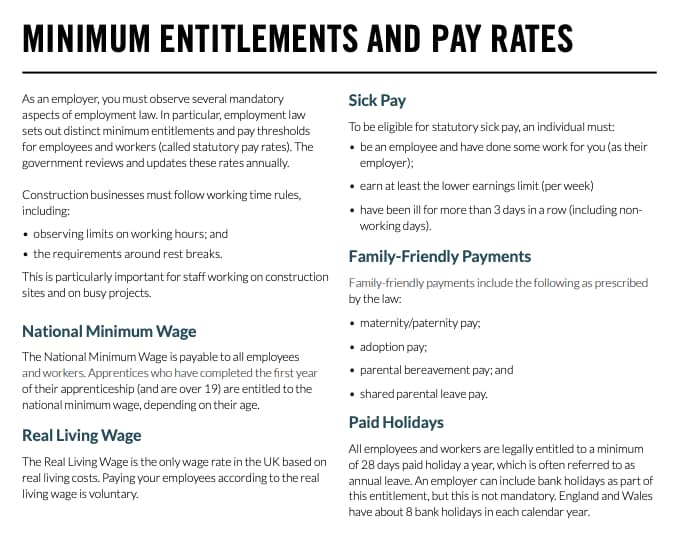

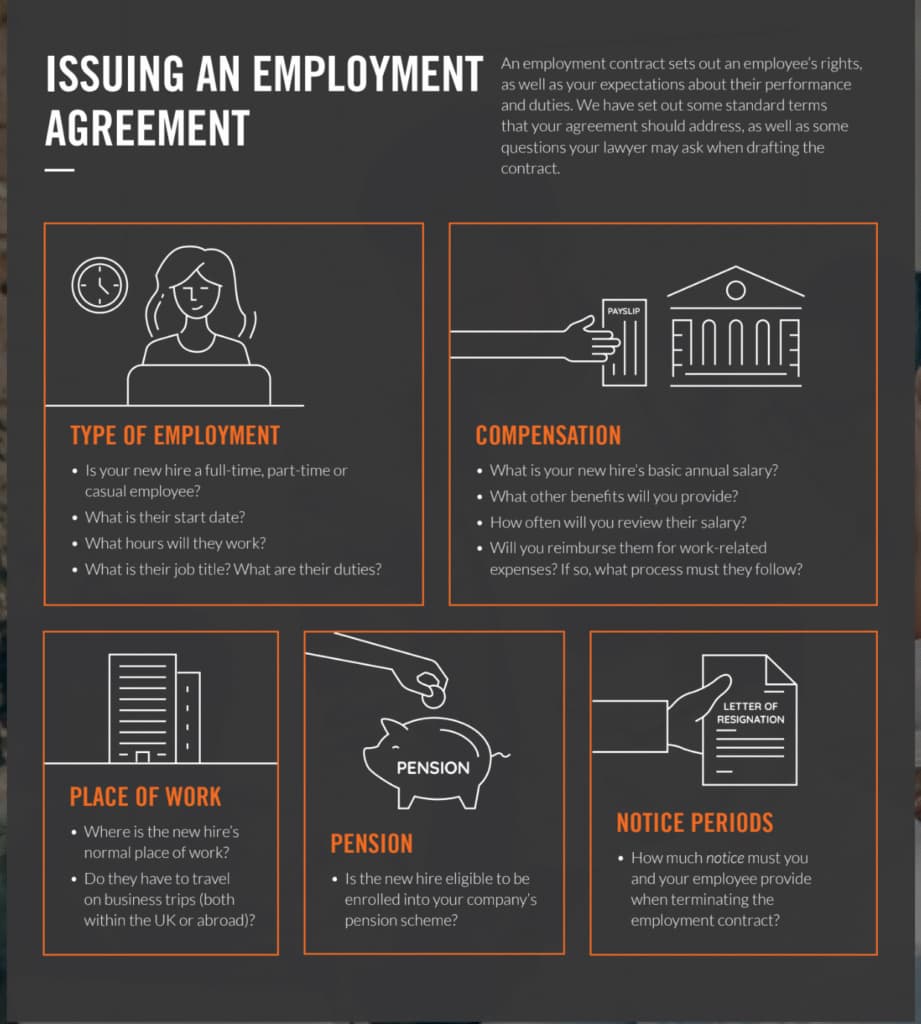

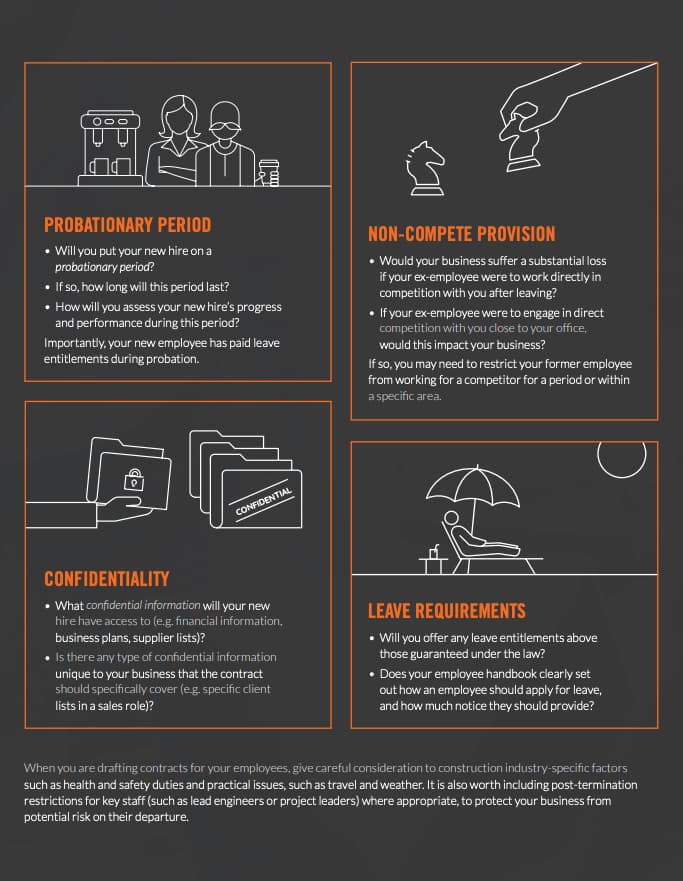

Growing Your Team

It is important to know who you are hiring and for what purpose. In the UK, you must consider whether an individual you hire will be an employee, a worker or self-employed independent contractor. You will need to carefully explore the legal implications of each status, as it will impact the benefits, tax treatment and the legal obligations you owe to staff as well as what rights they have at work.

Employment Status Types

- Employees: This includes full-time or part-time employees under an employment contract. Employees are entitled to full employment rights. You must provide written terms of employment to them on or before their first day of employment.

- Workers: These are individuals who occasionally work for your company under a “casual” or “zero hours” contract. You do not have to offer them work, and when you do, they do not have to accept it. They are entitled to certain rights and protection, but not all types of protections afforded to employees.

- Self-employed contractors: These individuals are neither employees nor workers. They provide services to clients (usually under a contract for services or ‘consultancy agreement’) personally, or through a personal services company. They must manage their own tax payments and are not entitled to employment protections under employment laws, except for protection for health and safety, and against discrimination.

For tax and employment law purposes, it is important to correctly identify self-employed contractors in your business.

Be Aware

Providing a Safe Workplace

Health and safety law compliance is critical in construction. The core responsibilities of providing a safe workplace are set out in the Health and Safety at Work etc. Act 1974, which is supported by regulations to manage risks across the industry. Other key obligations include:

- Those under the CDM Regulations 2015, including legal duties on clients, principal designers and principal contractors to plan, coordinate and manage health and safety throughout a project. This applies during the pre-construction and construction phases.

- Further legal obligations around site safety, fire safety, and building safety.

Inspections

Preventing Psychosocial Hazards

In addition to protecting your staff’s physical safety, your business must take steps to prevent psychological harm in the workplace.

Legal Duty

A psychosocial hazard is any workplace factor that may cause psychological harm. These can arise from the nature or organisation of work, the working environment, or the way people interact at work.

Where you identify psychosocial risks, your business should:

- assess the level of risk to mental health as part of your workplace risk assessments.

- implement control measures to eliminate or reduce these risks, such as adjusting workloads, improving communication, or providing additional support.

- maintain and regularly review your control measures to ensure they remain effective.

Some examples of psychosocial hazards include:

- excessive or unmanageable job demands.

- unclear job roles or expectations.

- poor management support or lack of recognition.

- bullying, harassment or discrimination.

Examples of Psychosocial Hazards in Construction

All employers need to carry out a suitable and sufficient workplace risk assessment, to include consideration of psychosocial hazards. Failure to do so may result in enforcement action.

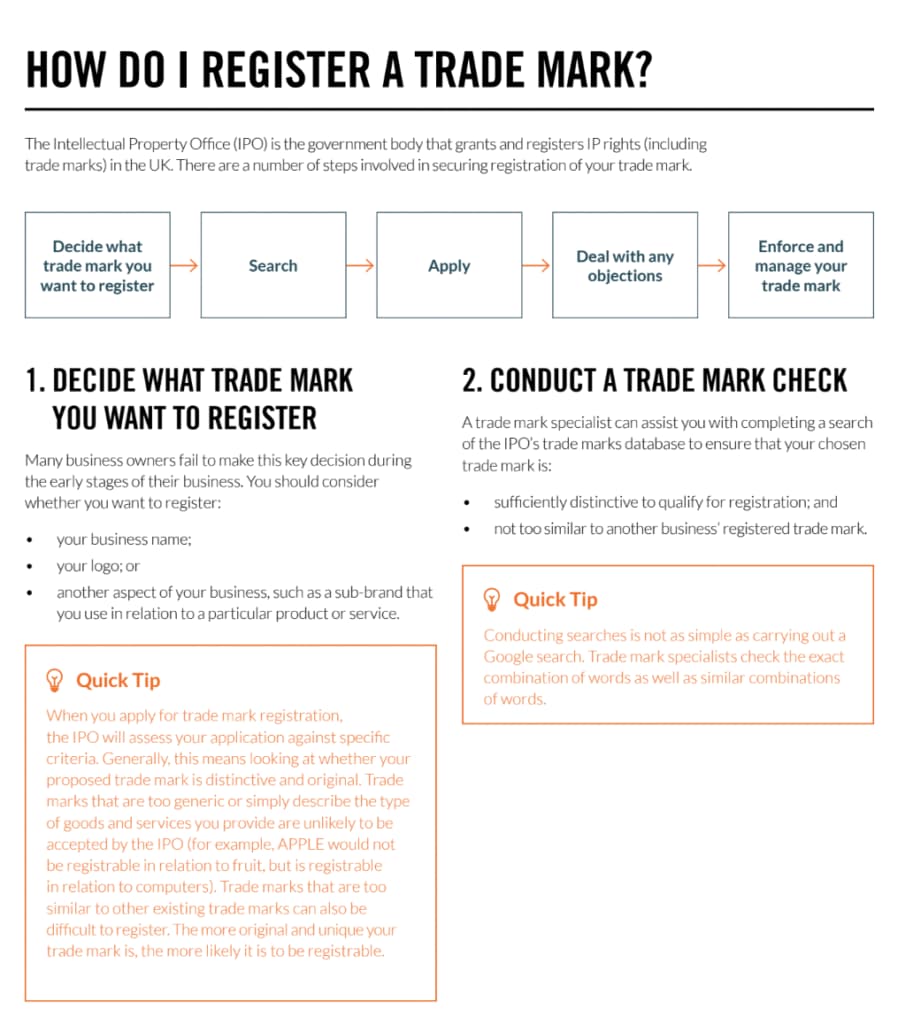

Protecting Your Brand

Intellectual property can be one of your most valuable assets as a business. When you have worked hard to build your reputation and brand, you do not want a competitor to take advantage of your efforts. This can cause confusion and damage your credibility.

A trade mark registration enables you to protect your brand and deter competitors. A trade mark can be a business name, logo, slogan, shape, colour, sound or even a smell, as long as it differentiates your business.

Quick Tip

Why Register a Trade Mark?

A trade mark registration can act as both a sword and a shield. It formally provides you with exclusive ownership and rights to use the trade mark (or to authorise others to use it), and to prevent unauthorised competitors from making use of the same or a similar trade mark. If protected properly, your trade mark can become one of the most valuable assets of your business.

If you do not register your trade mark, or register it incorrectly, you may end up spending significant time and money in disputes with competitors. You could ultimately lose the right to use your brand name or logo, resulting in a costly rebranding process.

Other Forms of IP Protection

Besides trade marks, there are other ways to protect your business innovations, designs and creative works. Patents, copyright, and design registrations are all common tools you can use to safeguard different parts of your business.

Smart businesses combine protections (such as patenting new technologies and registering trade marks and designs) to build a strong intellectual property portfolio. This creates a strong shield around your intellectual property assets. You can also make money from your protected ideas by selling or licensing them. This can open up new income streams for your business.

Quick Tip

Common IP Forms

- Copyright protects the expression of original ideas as soon as you record them. Owning copyright allows you to stop any unwanted copying or adaptation of your work.

- Application: Arises automatically when a qualifying original work is created.

- Length of Protection: Lasts typically for 70 years after the author dies.

- Patents are granted to protect new inventions by giving the inventor or owning business a legal monopoly right. Patents protect inventions such as products, processes or technical methods that are new, involve an inventive step and are capable of industrial application.

- Application: You must apply to register a patent. They offer strong legal protection but are usually expensive and time-consuming to obtain.

- Length of Protection: If successful, you gain a 20-year monopoly, provided you pay to renew it annually from the fourth year.

- Registered designs protect the appearance of all or part of a product, including the shape, configuration, pattern or ornamentation. Such designs must be new and have individual character in order to qualify for protection.

- Application: You can register a design relatively cheaply with the Intellectual Property Office.

- Length of Protection: This will last up to 25 years, if you renew it every five years.

What Are My Obligations?

Additionally, construction businesses process personal data belonging to individuals associated with their business. These individuals must be informed about how their personal information is being used. A common practice is to use a separate client-facing privacy policy and internal privacy notice for employees, contractors and workers. These vital documents can help demonstrate your compliance with data protection transparency obligations.

Construction projects can give rise to complex data protection considerations due to the way they operate in practice. For instance, project teams may use biometric access systems, monitor sites with CCTV, and share personal data between clients, contractors, and subcontractors. These activities raise complex data protection compliance rules.

Data Breach Actions

Resolving Commercial Disputes

No matter how successful your business is, at some stage you will likely end up in a commercial dispute. Problems with clients, suppliers, main contractors, subcontractors or consultants may all trigger disputes during a project.

Construction disputes often involve high costs, as parties must provide detailed expert evidence and project reports. Parties should effectively prevent and resolve disputes by:

- maintaining robust project records;

- drafting clear contract terms; and

- issuing contractual notices correctly and on time.

The table below outlines different types of commercial disputes.

Common Construction Disputes

| Defective works claims | These disputes can include claims over work quality issues and non-compliance with contractual specifications, material defects and remedial work requirements. |

| Variations and change orders | These can be disputes over additional work scope and whether such changes were authorised. |

| Payment disputes | Payment disputes can arise over non-payment or delayed payment for works performed and disagreements over final project costs. |

| Sub-contractor disputes | These claims can include payment issues, performance issues, and liability allocation through the subcontracting chain. |

| Design and specification disputes | These claims can involve allegations of professional negligence, design errors or omissions and failing to meet technical or contractual requirements. |

| Extension of time claims | These claims can arise where the relevant contractor requests deadline extensions to complete the works due to delays outside its control, often coupled with claims for associated damages. |

Resolving Disputes

Adjudication is the most widely used method of dispute resolution in construction. Parties may also choose mediation, expert determination, arbitration or court proceedings (usually in the Technology and Construction Court) to resolve more complex or high-value claims, or to obtain a final decision after adjudication.

Given the highly specialised and complex nature of construction disputes, businesses should seek legal advice from a dispute resolution lawyer on the most effective dispute resolution strategy.

Common Commercial Disputes

Checklist: Essential Legal Tasks

- Choose an appropriate business structure

- Implement Articles of Association and a Shareholder Agreement if you operate as a company with more than one shareholder

- Ensure compliance with all relevant legal rules that apply to your project

- Ensure a lawyer has drafted your key agreements so they are watertight and legally compliant where necessary

- Implement appropriate insurance coverage to protect your business against various potential risks

- Register trade marks for your business name and logo and develop a strategy to protect your wider intellectual property rights

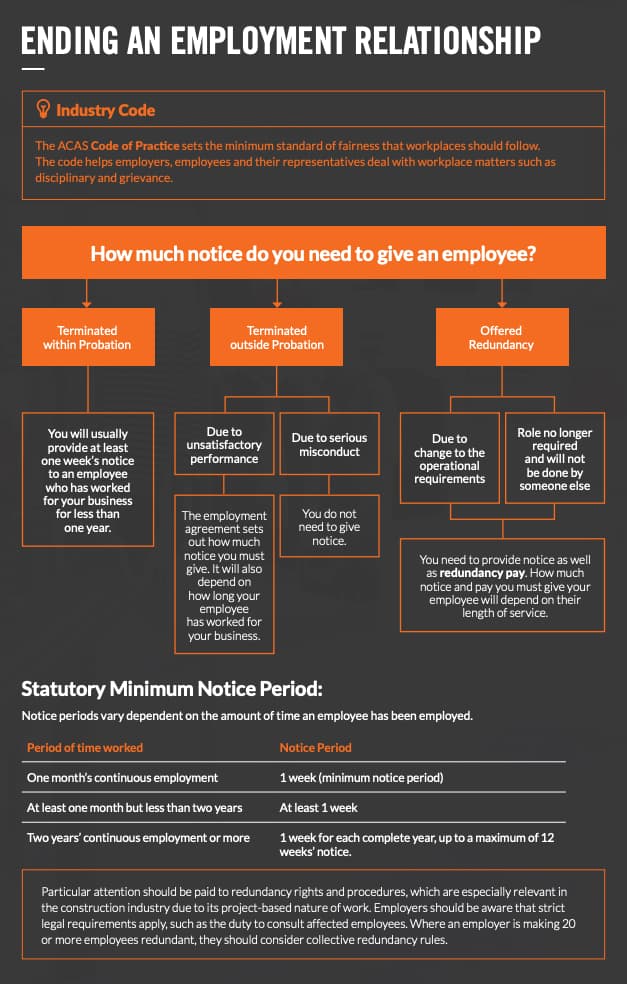

- Ensure compliance with employment laws, including correctly identifying the status of your staff and minimum entitlements

- Ensure compliance with data protection law rules

- Develop a strategy for resolving commercial disputes

- Review and update your legal documents and policies regularly to ensure they are legally sound and effective as your business grows

- Seek professional legal advice when needed

We appreciate your feedback – your submission has been successfully received.